Training Course on Law and Practice in International Banking and Commercial Payments

training course on Law and Practice in International Banking and Commercial Payments is meticulously designed to equip professionals with a robust understanding of the intricate legal frameworks and practical considerations governing global financial transactions.

Course Overview

Training Course on Law and Practice in International Banking and Commercial Payments

Introduction

This comprehensive training course on Law and Practice in International Banking and Commercial Payments is meticulously designed to equip professionals with a robust understanding of the intricate legal frameworks and practical considerations governing global financial transactions. In an increasingly interconnected world, the ability to navigate the complexities of cross-border banking regulations, international trade finance, and diverse payment systems is paramount for financial institutions, corporations engaged in international trade, and legal practitioners alike. This program delves into the fundamental legal principles underpinning international banking operations, including regulatory compliance, cross-border lending, and dispute resolution. Furthermore, it provides practical insights into the mechanisms of commercial payments, encompassing trade finance instruments like letters of credit and bank guarantees, as well as the evolving landscape of digital and cross-border payment technologies. Participants will gain critical knowledge to mitigate risks, ensure compliance, and facilitate seamless international financial activities, fostering efficiency and security in their organizations' global operations.

The curriculum addresses the core legal aspects of international banking, emphasizing the significance of regulatory frameworks, compliance standards, and risk management. It further explores the operational nuances of commercial payments, highlighting the legal implications of various payment methods and the role of key international payment systems. Through a blend of theoretical knowledge and practical case studies, this course aims to empower participants to confidently handle the legal and practical challenges inherent in international financial transactions. By focusing on trending keywords such as cross-border payments, trade finance law, international banking regulations, and commercial payment systems, the course content is designed to be highly relevant and searchable for professionals seeking expertise in this critical domain. This training will ultimately contribute to enhanced organizational efficiency, reduced legal and financial risks, and a competitive edge in the global marketplace.

Course Duration

10 days

Course Objectives

- Understand the fundamental legal principles of international banking.

- Analyze the key regulatory frameworks governing cross-border financial transactions.

- Evaluate the legal implications of correspondent banking relationships.

- Master the legal aspects of international trade finance instruments (e.g., letters of credit, bank guarantees).

- Navigate the compliance requirements for anti-money laundering (AML) and counter-terrorism financing in international banking.

- Assess the legal risks associated with cross-border lending and syndicated loans.

- Understand the legal framework for international payment systems (e.g., SWIFT, CHIPS).

- Examine the legal challenges and opportunities presented by fintech in international payments.

- Develop strategies for dispute resolution in international banking and commercial transactions.

- Comprehend the legal aspects of foreign exchange transactions and currency regulations.

- Analyze the impact of international sanctions and trade laws on banking operations.

- Apply best practices in drafting and reviewing international banking and commercial contracts.

- Stay updated on the emerging legal trends in global banking and payments.

Organizational Benefits

- Enhanced Compliance: Equipping employees with a thorough understanding of international banking and commercial payment laws minimizes the risk of non-compliance and potential penalties.

- Reduced Legal Risks: Comprehensive knowledge of legal frameworks enables organizations to proactively identify and mitigate legal risks associated with cross-border financial activities.

- Improved Efficiency: Streamlined processes and a better understanding of payment systems lead to more efficient international transactions.

- Increased Security: Understanding legal and regulatory requirements helps in implementing robust security measures against financial crime and fraud.

- Competitive Advantage: Organizations with well-trained staff in international banking law and practice can navigate global markets more effectively, gaining a competitive edge.

- Better Decision-Making: Informed employees can make sound decisions regarding international financial transactions, minimizing errors and maximizing opportunities.

- Stronger International Partnerships: A clear understanding of legal and payment frameworks facilitates smoother and more reliable relationships with international partners.

- Cost Savings: Avoiding legal disputes, penalties, and operational inefficiencies translates to significant cost savings for the organization.

- Enhanced Reputation: Adherence to international laws and best practices builds a strong and trustworthy reputation in the global financial arena.

- Adaptability to Change: Understanding emerging legal trends allows the organization to adapt proactively to changes in the international financial landscape.

Target Audience

- Banking and Finance Professionals: Including relationship managers, compliance officers, trade finance specialists, and legal counsel within financial institutions.

- Corporate Treasury Managers: Responsible for managing international payments, foreign exchange risk, and cross-border financing for multinational corporations.

- Legal Advisors Specializing in Finance: Providing legal guidance on international banking, trade finance, and regulatory compliance.

- Payment Service Providers: Involved in facilitating cross-border payment solutions and needing to understand the relevant legal and regulatory landscape.

- Government Regulators and Central Bank Officials: Overseeing and formulating policies related to international banking and payment systems.

- Trade Finance Practitioners: Professionals involved in structuring and executing international trade finance transactions.

- Auditors and Risk Management Professionals: Assessing and mitigating risks associated with international banking and commercial payments.

- Academics and Researchers: Focusing on international financial law and regulation.

Course Outline

Module 1: Foundations of International Banking Law

- Introduction to the international financial system and its legal framework.

- Principles of jurisdiction and applicable law in cross-border banking.

- The role of international treaties and conventions in banking regulation.

- Understanding the Basel Accords and their impact on international banking.

- Legal challenges in the international banking environment.

Module 2: Regulatory Frameworks for Commercial Payments

- Overview of international payment systems: SWIFT, CHIPS, and others.

- Regulatory requirements and compliance standards for commercial payments.

- Legal considerations in international letters of credit and bank guarantees.

- The role of financial institutions in facilitating commercial payments.

- Legal implications of digital and cryptocurrency payments in international trade.

Module 3: Cross-Border Lending and Syndicated Loans

- Legal aspects of cross-border loan agreements and documentation.

- Understanding sovereign debt and its legal implications.

- The structure and legal framework of syndicated loans in international finance.

- Risk assessment and legal due diligence in cross-border lending.

- Dispute resolution mechanisms in international loan agreements.

Module 4: International Trade Finance Law

- Legal principles governing international sale of goods contracts (e.g., Incoterms).

- Documentary credits (letters of credit) and their legal framework under UCP 600.

- Bank guarantees and standby letters of credit in international trade.

- Legal issues in trade finance fraud and mitigation strategies.

- The role of international arbitration in trade finance disputes.

Module 5: Anti-Money Laundering and Counter-Terrorism Financing in Global Banking

- International legal standards and FATF recommendations on AML/CTF.

- Customer Due Diligence (CDD) and Know Your Customer (KYC) obligations in cross-border transactions.

- Reporting suspicious transactions and regulatory compliance requirements.

- Legal implications of sanctions and embargoes on international banking operations.

- Developing effective AML/CTF compliance programs for financial institutions.

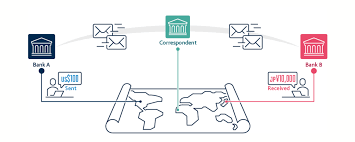

Module 6: Legal Aspects of Correspondent Banking

- Understanding the legal framework governing correspondent banking relationships.

- Due diligence and risk assessment in establishing correspondent accounts.

- Legal responsibilities of correspondent banks in cross-border payments.

- Challenges and regulatory expectations in correspondent banking.

- Strategies for managing legal and compliance risks in correspondent banking networks.

Module 7: Cross-Border Payment Systems and Technologies

- The legal and operational framework of SWIFT messaging system.

- Understanding the CHIPS and other major international payment systems.

- Legal implications of emerging payment technologies (e.g., blockchain, digital currencies).

- Regulatory challenges in the cross-border payments landscape.

- Data privacy and security considerations in international payment processing.

Module 8: Fintech and the Future of International Payments Law

- The impact of financial technology (fintech) on cross-border payments.

- Legal and regulatory approaches to digital currencies and blockchain in finance.

- Challenges and opportunities in regulating cross-border fintech solutions.

- The role of innovation hubs and regulatory sandboxes in shaping fintech law.

- Future trends in the legal landscape of international payments.

Module 9: Dispute Resolution in International Banking and Commerce

- Overview of different methods of international dispute resolution (litigation, arbitration, mediation).

- Legal frameworks for enforcing international court judgments and arbitral awards.

- The role of international arbitration institutions (e.g., ICC, LCIA) in banking and trade disputes.

- Strategies for drafting effective dispute resolution clauses in international contracts.

- Case studies of significant legal disputes in international banking and commercial payments.

Module 10: Foreign Exchange Regulations and Currency Law

- Legal framework governing foreign exchange transactions and controls.

- Understanding the role of central banks in currency regulation.

- Legal implications of currency convertibility and exchange rate regimes.

- Managing legal risks associated with foreign exchange exposure.

- International agreements and regulations related to currency manipulation.

Module 11: International Sanctions and Trade Laws

- Understanding the legal basis and impact of international sanctions regimes.

- Compliance obligations for financial institutions under various sanctions programs.

- The interplay between trade laws and international banking regulations.

- Legal challenges in navigating complex and evolving sanctions landscapes.

- Best practices for ensuring compliance with international sanctions and trade laws.

Module 12: Drafting and Negotiating International Banking and Commercial Contracts

- Key legal principles in drafting international financial agreements.

- Essential clauses in cross-border loan agreements and security documentation.

- Drafting considerations for international trade finance instruments.

- Techniques for effective negotiation of international banking and commercial contracts.

- Understanding the impact of different legal systems on contract interpretation.

Module 13: Legal Issues in Cross-Border Insolvency

- Principles of cross-border insolvency law and international cooperation.

- The impact of insolvency proceedings on international banking transactions.

- Legal frameworks for the recognition and enforcement of foreign insolvency proceedings.

- Strategies for protecting assets and recovering claims in cross-border insolvency cases.

- Recent developments and trends in international insolvency law.

Module 14: Cybersecurity and Data Protection in International Banking and Payments

- Legal and regulatory requirements for cybersecurity in the financial sector.

- Data privacy laws and their implications for cross-border data transfers in banking.

- Liability for data breaches and cyber fraud in international financial transactions.

- Best practices for implementing robust cybersecurity measures.

- Legal frameworks for international cooperation in combating cybercrime.

Module 15: Emerging Trends and Future Challenges in International Financial Law

- The legal implications of sustainable finance and green banking initiatives.

- Regulatory responses to the rise of decentralized finance (DeFi).

- The future of cross-border payments in the digital age.

- Addressing legal and ethical challenges posed by artificial intelligence in finance.

- Anticipating future trends and adapting legal strategies in the evolving international financial landscape.

Training Methodology

The training will employ a blended learning approach, incorporating:

- Interactive Lectures: Engaging presentations covering key legal principles and practical applications.

- Case Studies: Analysis of real-world scenarios and legal precedents in international banking and commercial payments.

- Group Discussions: Facilitating peer learning and the exchange of insights and experiences.

- Practical Exercises: Applying learned concepts through simulations and problem-solving activities.

- Guest Speaker Sessions: Insights from experienced legal and banking professionals in the field.

- Online Resources: Access to supplementary materials, articles, and relevant legal documents.

- Q&A Sessions: Opportunities for participants to clarify doubts and engage with the instructors.

Register as a group from 3 participants for a Discount

Send us an email: [email protected] or call +254724527104

Certification

Upon successful completion of this training, participants will be issued with a globally- recognized certificate.

Tailor-Made Course

We also offer tailor-made courses based on your needs.

Key Notes

a. The participant must be conversant with English.

b. Upon completion of training the participant will be issued with an Authorized Training Certificate

c. Course duration is flexible and the contents can be modified to fit