Training course on Climate Risk Assessment and Adaptation in Real Estate

Training Course on Climate Risk Assessment and Adaptation in Real Estate is meticulously designed to equip with the expert-level knowledge and practical methodologies.

Course Overview

Training Course on Climate Risk Assessment and Adaptation in Real Estate

Introduction:

The real estate sector is increasingly exposed to significant financial and operational risks stemming from climate change, making climate risk assessment and adaptation an urgent priority for safeguarding asset value and ensuring long-term resilience. Training Course on Climate Risk Assessment and Adaptation in Real Estate is meticulously designed to equip with the expert-level knowledge and practical methodologies. This specialized program focuses on understanding physical and transition climate risks, applying advanced assessment methodologies (e.g., scenario analysis, TCFD recommendations), developing targeted adaptation measures, and integrating climate considerations into financial decision-making, blending in-depth understanding of climate science data, practical risk quantification techniques, resilient design principles, and effective communication strategies, and the leveraging of real-world case studies and frameworks (including those relevant to the Kenyan market) to build truly resilient portfolios and contribute to a sustainable built environment.

This comprehensive 5-day program delves into nuanced methodologies for identifying asset-specific physical climate vulnerabilities (e.g., flood risk mapping for properties in Nairobi, assessing heat stress for buildings), mastering sophisticated techniques for evaluating transition risks (e.g., the impact of future carbon taxes on property operating costs, shifts in tenant demand for green buildings), and exploring cutting-edge approaches to designing and implementing climate-resilient features (e.g., flood-proof structures, passive cooling systems, drought-resistant landscaping), and integrating climate risk disclosures (e.g., TCFD). A significant focus will be placed on understanding the interplay of local climate data and global climate scenarios, the specific challenges and opportunities in the Kenyan real estate market (e.g., government initiatives for green affordable housing, the role of Nature-Based Solutions for urban resilience, and the Kenya Green Finance Taxonomy), and the application of climate adaptation strategies to diverse real estate asset classes from residential to commercial and industrial. By integrating global industry best practices in climate risk management, analyzing **real-world examples of successful climate adaptation projects (including pioneering initiatives in Kenya like Two Rivers Mall's water recycling and flood management systems), and engaging in intensive hands-on risk mapping exercises, adaptation strategy workshops, financial impact modeling, and expert-led discussions on policy and regulation, attendees will develop the strategic acumen to confidently manage climate risks, fostering unparalleled asset protection, enhanced marketability, and long-term financial stability, thereby securing their position as indispensable leaders in building a climate-resilient real estate future.

Course Objectives:

Upon completion of this course, participants will be able to:

- Analyze core principles and strategic responsibilities of climate risk assessment and adaptation in transforming real estate development and investment.

- Master sophisticated techniques for identifying and classifying physical climate risks (e.g., flooding, heat stress, drought) relevant to real estate assets.

- Develop robust strategies for assessing and quantifying transition climate risks (e.g., policy, technology, market shifts) impacting property values.

- Implement effective methodologies for conducting asset-level and portfolio-level climate risk assessments, including scenario analysis.

- Manage complex climate data and models to generate actionable insights for real estate decision-making.

- Apply robust strategies for designing and integrating climate adaptation measures into new and existing real estate projects.

- Understand the deep integration of climate risk assessment with financial modeling and valuation, including Climate Value-at-Risk (CVaR).

- Leverage knowledge of key reporting frameworks such as TCFD (Task Force on Climate-related Financial Disclosures) for transparent climate risk disclosure.

- Optimize strategies for enhancing the climate resilience of real estate assets through design, technology, and operational changes.

- Formulate specialized adaptation plans for different real estate asset classes and geographic contexts (e.g., coastal properties vs. urban centers like Nairobi).

- Conduct comprehensive due diligence to incorporate climate risk into real estate acquisitions and dispositions.

- Navigate challenging situations such as data uncertainty, stakeholder resistance, and the evolving regulatory landscape of climate disclosure.

- Develop a holistic, practical, and forward-looking approach to climate risk assessment and adaptation, with a focus on maximizing resilience and value in Kenya and globally.

Target Audience:

This course is designed for real estate professionals interested in Climate Risk Assessment and Adaptation:

- Real Estate Investors & Fund Managers: Assessing climate risks in portfolios and making resilient investment decisions.

- Real Estate Developers & Project Managers: Integrating climate resilience into design, construction, and development.

- Property & Asset Managers: Managing physical climate risks and enhancing the resilience of existing buildings.

- Real Estate Valuers & Appraisers: Incorporating climate risk into property valuation methodologies.

- Sustainability & ESG Professionals in Real Estate: Leading climate risk strategies and reporting.

- Financial Institutions & Lenders (Real Estate Portfolios): Understanding climate-related financial risks.

- Urban Planners & Local Government Officials: Developing climate-resilient urban strategies and policies.

- Real Estate Consultants: Providing expert advice on climate risk and adaptation to clients.

Course Duration: 5 Days

Course Modules

- Module 1: Foundations of Climate Risk in Real Estate

- Understanding Climate Change Science: Basic concepts, observed impacts, and future projections relevant to the built environment.

- Defining Physical Climate Risks: Acute (e.g., floods, storms, wildfires, extreme heat) and Chronic (e.g., sea-level rise, chronic temperature shifts, water scarcity).7

- Defining Transition Climate Risks: Policy and legal (e.g., carbon taxes, stricter building codes), Technology (e.g., disruptive energy tech), Market (e.g., changing tenant preferences), Reputation.8

- Impact on Real Estate Value Chain: Due diligence, acquisition, development, operations, financing, insurance, and divestment.

- Climate Risks in Nairobi, Kenya: Specific focus on urban flooding, heat island effect, water stress, and potential for drought-related impacts on construction.

- Module 2: Climate Risk Assessment Methodologies

- Data Sources for Climate Risk Assessment: Climate models (e.g., RCPs, SSPs), historical data, hazard maps, geospatial data, and property-specific information.9

- Asset-Level vs. Portfolio-Level Assessment: Methodologies for granular and aggregated risk evaluation.

- Scenario Analysis for Real Estate: Using different warming scenarios (e.g., 1.5°C, 2°C, 4°C) to test portfolio resilience.

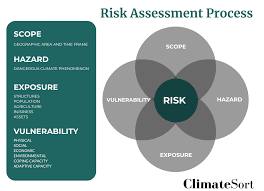

- Vulnerability Assessment: Identifying specific vulnerabilities of building types, locations, and infrastructure to various climate hazards.10

- Risk Quantification: Approaches to estimate potential financial losses (e.g., repair costs, business interruption, devaluation) from climate impacts.11

- Module 3: Physical Climate Risk Assessment & Tools

- Flood Risk Assessment: Pluvial, fluvial, and coastal flooding. Tools for flood mapping and predictive modeling for urban areas like Nairobi.

- Heat Stress & Drought Risk: Analyzing urban heat island effect, water availability projections, and their impact on building performance and landscaping.

- Wind & Storm Risk: Assessing building vulnerability to extreme winds and storm surges, especially for high-rise commercial properties.

- Geotechnical & Soil Stability Risks: Understanding the impact of changing precipitation patterns on subsidence and landslides.

- Utilizing Climate Risk Analytics Platforms: Overview of commercial tools (e.g., ClimateCheck, Four Twenty Seven, Moody's ESG Solutions) for real estate.

- Module 4: Transition Climate Risk Assessment & Implications

- Policy & Regulatory Risk: Analyzing the impact of evolving building codes, energy efficiency standards (e.g., potential future carbon intensity regulations in Kenya), and carbon pricing mechanisms.

- Technology & Market Risk: Assessing the obsolescence risk of energy-intensive assets, and the growing demand for green, resilient properties.

- Reputation & Litigation Risk: Understanding the impact of climate-related events and poor ESG performance on public perception and legal exposure.

- Carbon Footprint & Emissions Measurement: Scope 1, 2, and relevant Scope 3 emissions for real estate portfolios, and their role in transition risk.

- Green Building Standards & Certifications: How they mitigate transition risks by demonstrating leadership and compliance.

- Module 5: Climate Adaptation Strategies for Real Estate

- Resilient Design Principles: Passive design, material selection for durability, elevated foundations, and flood barriers for new construction.

- Building Retrofits & Upgrades: Adaptation measures for existing buildings (e.g., flood-proofing, enhanced insulation, cool roofs, water harvesting in Kenya).

- Green Infrastructure & Nature-Based Solutions: Integrating permeable surfaces, green roofs, urban forestry, and bioswales for stormwater management and urban cooling in Nairobi.

- Water Management & Conservation: Advanced water recycling, greywater systems, and drought-resistant landscaping for commercial properties.

- Energy Resilience: Backup power systems, microgrids, and on-site renewable energy for operational continuity during climate events.12

- Module 6: Integrating Climate Risk into Real Estate Finance & Valuation

- Climate Value-at-Risk (CVaR): Quantifying the potential financial impact of climate risks on asset and portfolio value.

- Due Diligence for Climate Risk: Incorporating climate risk assessments into real estate acquisition and divestment processes.

- Impact on Property Valuation: Adjusting valuation models to account for climate risks and adaptation costs/benefits.

- Insurance & Climate Risk: Understanding the evolving landscape of property insurance, premiums, and insurability in high-risk zones.

- Green Finance & Investment: Accessing capital for resilient development, including sustainability-linked loans and green bonds, and aligning with Kenya's Green Finance Taxonomy.

- Module 7: Governance, Reporting & Stakeholder Engagement

- TCFD Recommendations in Real Estate: Detailed understanding of Governance, Strategy, Risk Management, and Metrics & Targets for climate disclosure.

- ESG Reporting & Real Estate: Integrating climate risk disclosures into broader ESG reporting frameworks (e.g., GRESB, GRI).

- Stakeholder Engagement: Communicating climate risks and adaptation plans to investors, tenants, insurers, and local communities.13

- Policy Advocacy & Collaboration: Engaging with government and industry bodies to shape supportive climate resilience policies in Kenya.

- Developing a Climate Risk Management Framework: Establishing internal processes for ongoing monitoring, assessment, and adaptation.

- Module 8: Case Studies & Future Outlook for Climate Resilience

- Local & Global Best Practices: Analyzing successful climate risk assessment and adaptation projects in diverse real estate contexts, with a focus on examples from Kenya (e.g., flood management at Two Rivers Mall, green affordable housing initiatives).

- Adaptive Urban Planning in Kenya: Discussing ongoing efforts and challenges in building climate-resilient cities in Kenya (e.g., Nairobi's efforts to address urban flooding).

- Emerging Technologies for Resilience: Satellite monitoring, AI for predictive analytics, and advanced materials for climate adaptation.

- Scenario Planning Workshop: Participants apply learned methodologies to a real-world (or hypothetical) Kenyan real estate project, identifying key risks and proposing adaptation strategies.

- Future of Climate Resilience in Real Estate: Long-term trends, the role of public-private partnerships, and the evolution of climate-related regulations.

Training Methodology

- Interactive Workshops: Facilitated discussions, group exercises, and problem-solving activities.

- Case Studies: Real-world examples to illustrate successful community-based surveillance practices.

- Role-Playing and Simulations: Practice engaging communities in surveillance activities.

- Expert Presentations: Insights from experienced public health professionals and community leaders.

- Group Projects: Collaborative development of community surveillance plans.

- Action Planning: