Training course on Asset Management for Institutional Real Estate Portfolios

Training Course on Asset Management for Institutional Real Estate Portfolios is meticulously designed to equip with the advanced theoretical insights and intensive practical tools necessary to excel in Asset Management for Institutional Real Estate Portfolios.

Course Overview

Training Course on Asset Management for Institutional Real Estate Portfolios

Introduction

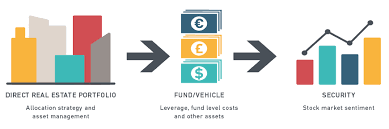

Asset Management for Institutional Real Estate Portfolios is a highly specialized and strategic discipline focused on maximizing the value, performance, and risk-adjusted returns of large, diversified real estate holdings for institutional investors. Unlike property management, which focuses on day-to-day operations, asset management takes a macro, long-term view, encompassing investment strategy, financial performance optimization, capital allocation, risk mitigation, and disposition planning across an entire portfolio. It involves making critical decisions about acquisitions, capital improvements, financing structures, and market positioning to achieve the specific investment objectives of pension funds, sovereign wealth funds, endowments, and private equity vehicles. For asset managers, portfolio managers, investment professionals, and senior real estate executives, a profound command of these advanced methodologies is paramount for navigating complex market cycles, achieving superior investor returns, and ensuring the long-term stewardship of significant capital. Failure to implement robust asset management strategies can lead to underperforming assets, inefficient capital deployment, and ultimately, erosion of investor trust and financial value.

Training Course on Asset Management for Institutional Real Estate Portfolios is meticulously designed to equip aspiring and current asset managers, portfolio managers, institutional investors, real estate fund managers, and senior investment professionals with the advanced theoretical insights and intensive practical tools necessary to excel in Asset Management for Institutional Real Estate Portfolios. We will delve into sophisticated methodologies for developing and executing cohesive portfolio investment strategies aligned with diverse investor mandates, master the intricacies of advanced financial modeling, performance measurement, and strategic capital allocation across various property types and geographies, and explore cutting-edge approaches to proactive risk management, value creation initiatives, and transparent investor reporting. A significant focus will be placed on understanding market cycles, navigating complex financing structures, optimizing operational oversight, and developing effective disposition plans. By integrating industry best practices, analyzing real-world complex institutional portfolio case studies, and engaging in hands-on portfolio analysis, strategic planning, and performance optimization exercises, attendees will develop the strategic acumen to confidently lead and enhance the performance of large-scale real estate portfolios, fostering unparalleled value maximization, risk mitigation, and long-term investor success, and securing their position as indispensable assets in the forefront of institutional real estate investment.

Course Objectives

Upon completion of this course, participants will be able to:

- Analyze the fundamental principles and strategic role of asset management within institutional real estate.

- Develop comprehensive portfolio investment strategies aligned with institutional objectives and risk appetites.

- Master advanced acquisition and underwriting techniques for adding assets to a portfolio.

- Apply sophisticated financial modeling and valuation methodologies for portfolio-level analysis.

- Implement effective operational oversight and property management integration for portfolio optimization.

- Conduct rigorous performance measurement, reporting, and benchmarking for institutional portfolios.

- Formulate strategic capital planning, value-add, and redevelopment initiatives to enhance portfolio value.

- Apply robust risk management frameworks for diverse institutional real estate portfolios.

- Comprehend various disposition strategies and their impact on portfolio returns and investor relations.

- Understand the nuances of financing strategies and capital stacking at the portfolio level.

- Leverage data analytics and technology (PropTech) for informed asset management decisions.

- Navigate complex investor relations and fund governance in an institutional context.

- Design a holistic asset management plan for optimizing institutional real estate portfolios.

Target Audience

This course is designed for professionals managing or investing in large, institutional real estate portfolios:

- Asset Managers: Responsible for strategic oversight and performance of real estate assets.

- Portfolio Managers: Directing overall investment strategy and allocation for real estate.

- Institutional Investors (Pension Funds, Endowments): Overseeing direct or indirect real estate investments.

- Real Estate Fund Managers: Managing the lifecycle and performance of real estate investment funds.

- Investment Analysts: Supporting strategic decisions for large real estate portfolios.

- Senior Real Estate Executives: Leading asset management divisions or investment teams.

- Financial Advisors to HNWIs/Family Offices: Managing large, diversified real estate holdings.

- Real Estate Consultants: Advising institutional clients on asset and portfolio strategies.

Course Duration: 5 Days

Course Modules

Module 1: Strategic Role of Asset Management & Portfolio Strategy

- Defining asset management in the context of institutional real estate vs. property management.

- Understanding diverse institutional investor mandates and risk-return objectives.

- Developing overarching portfolio investment strategies (core, value-add, opportunistic).

- The concept of strategic asset allocation across property types, geographies, and risk profiles.

- Aligning asset management decisions with fund-level and investor-level goals.

Module 2: Portfolio Acquisition, Due Diligence & Underwriting

- Sourcing and evaluating new acquisition opportunities for portfolio fit and value creation.

- Conducting comprehensive due diligence for potential new assets (financial, physical, legal, environmental).

- Advanced underwriting techniques: pro forma modeling, risk adjusted return analysis.

- Integrating new acquisitions into existing portfolio structures and management frameworks.

- Post-acquisition integration and initial asset management planning.

Module 3: Financial Modeling & Valuation for Portfolios

- Building sophisticated portfolio-level financial models and aggregation techniques.

- Advanced valuation methodologies (DCF, cap rates, residual value) applied to portfolio assets.

- Projecting portfolio-wide cash flows, distributions, and investor returns.

- Sensitivity analysis and scenario planning for macro and micro-economic variables on portfolio performance.

- Understanding the impact of leverage and capital structures on portfolio-level returns.

Module 4: Operational Oversight & Property Management Integration

- Implementing effective oversight mechanisms for third-party property managers.

- Setting clear performance expectations and KPIs for property-level operations.

- Leveraging property management data for asset-level insights and portfolio optimization.

- Strategies for optimizing operational expenses and maximizing Net Operating Income (NOI).

- Ensuring property management aligns with asset management strategic objectives.

Module 5: Performance Measurement, Reporting & Benchmarking

- Key performance indicators (KPIs) for institutional real estate portfolios (e.g., total return, income return, capital appreciation).

- Calculating Gross Asset Value (GAV), Net Asset Value (NAV), and Fund-Level IRR.

- Benchmarking portfolio performance against NCREIF, MSCI, or other relevant indices.

- Developing transparent and comprehensive investor reports (quarterly, annual).

- Communicating performance, market outlook, and strategic adjustments to limited partners (LPs).

Module 6: Capital Planning, Value-Add & Redevelopment Strategies

- Long-term capital planning for portfolio assets: identifying and funding major repairs and upgrades.

- Identifying value-add opportunities: renovations, repositioning, lease-up strategies.

- Evaluating the feasibility and ROI of redevelopment and ground-up development within the portfolio.

- Managing construction risks, budget overruns, and timeline adherence for capital projects.

- Maximizing the "promote" or carried interest through strategic value creation.

Module 7: Risk Management & Portfolio Optimization

- Identifying and assessing macro and micro-level risks across the institutional portfolio (market, credit, liquidity, operational, regulatory).

- Implementing hedging strategies for currency and interest rate exposure.

- Diversification strategies: geographic, property type, tenant mix, lease expiration profile.

- Utilizing portfolio analytics to optimize risk-adjusted returns (e.g., Efficient Frontier analysis).

- Developing contingency plans for market downturns or unforeseen events.

Module 8: Disposition Strategies & Fund/Investor Relations

- Formulating strategic disposition plans for individual assets or entire portfolios.

- Evaluating timing for sales based on market cycles, investment horizons, and fund objectives.

- Understanding different exit mechanisms (asset sale, entity sale, recapitalization).

- Managing the disposition process: broker selection, marketing, negotiation, closing.

- Communicating disposition results and their impact on fund returns to investors.

Training Methodology

- Interactive Workshops: Facilitated discussions, group exercises, and problem-solving activities.

- Case Studies: Real-world examples to illustrate successful community-based surveillance practices.

- Role-Playing and Simulations: Practice engaging communities in surveillance activities.

- Expert Presentations: Insights from experienced public health professionals and community leaders.

- Group Projects: Collaborative development of community surveillance plans.

- Action Planning: Development of personalized action plans for implementing community-based surveillance.

- Digital Tools and Resources: Utilization of online platforms for collaboration and learning.

- Peer-to-Peer Learning: Sharing experiences and insights on community engagement.

- Post-Training Support: Access to online forums, mentorship, and continued learning resources.

Register as a group from 3 participants for a Discount

Send us an email: [email protected] or call +254724527104

Certification

Upon successful completion of this training, participants will be issued with a globally recognized certificate.

Tailor-Made Course

We also offer tailor-made courses based on your needs.

Key Notes

- Participants must be conversant in English.

- Upon completion of training, participants will receive an Authorized Training Certificate.

- The course duration is flexible and can be modified to fit any number of days.

- Course fee includes facilitation, training materials, 2 coffee breaks, buffet lunch, and a Certificate upon successful completion.

- One-year post-training support, consultation, and coaching provided after the course.

- Payment should be made at least a week before the training commencement to DATASTAT CONSULTANCY LTD account, as indicated in the invoice, to enable better preparation.